Supplier PDF Invoice | Invoice Pre-Match | Payment Request | Consolidated Approval | Next-day Payment | Instant Reconciliation

Accounts Payable Solutions – Your New Strategic Partner

Paying Suppliers on-time in an efficient, cost-effective manner establishes business continuity and builds strong supplier relationships. Often, Accounts Payable teams are stretched too thin and tactically focused from mounting supplier inquiries, inaccurate payments, errors, rising invoice volumes, and regulations.

Shift Gears with our Accounts Payable Solutions

Let AP become a strategic business partner through invoice and payment digitization. Ivalua’s cloud-based Invoice-to-Pay solution automates payment processes, providing visibility into the entire transaction to ensure collaboration between AP, the business, and suppliers. Transform your Accounts Payable function from a tactical cost center into a strategic business partner — and possibly even a revenue generator.

Transform your Payment Process

Transparent User Journey

- Reduce supplier inquiries

- Instant payment status

- 2FA secure approvals

Streamline AP Functions

- Eliminate manual tasks

- Block payment duplications

- Automated reconciliation

Global Payments

- Consolidate supplier payments

- International & domestic in one flow

- Global next-day payments

A Unified Platform for All Spend

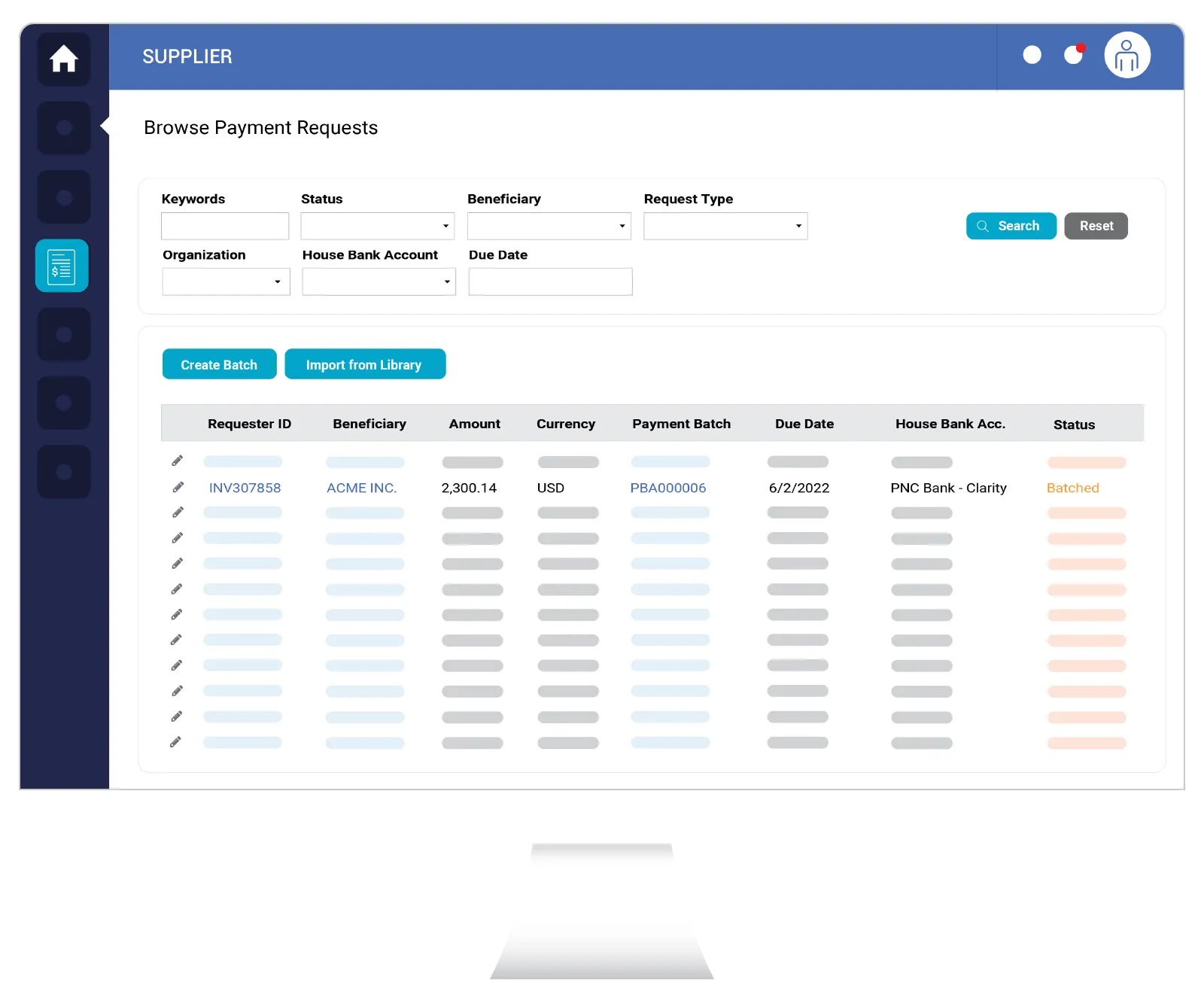

Payment Request

Global Payment Automation

- Automated payment batches and multi-currency transactions

- Pay from multiple bank accounts

- Instant Status Updates

- Runs in parallel to other payment methods